The smart Trick of Tax Consultant Vancouver That Nobody is Discussing

Table of ContentsExcitement About Small Business Accountant VancouverNot known Details About Tax Accountant In Vancouver, Bc Pivot Advantage Accounting And Advisory Inc. In Vancouver for BeginnersExcitement About Small Business Accounting Service In VancouverRumored Buzz on Small Business Accounting Service In VancouverWhat Does Vancouver Tax Accounting Company Mean?

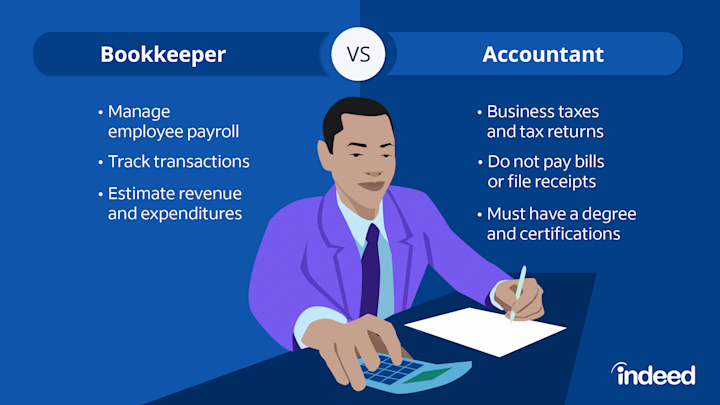

Here are some benefits to working with an accounting professional over a bookkeeper: An accounting professional can provide you a thorough sight of your organization's financial state, in addition to methods and also suggestions for making monetary choices. Meanwhile, bookkeepers are only accountable for taping economic transactions. Accountants are needed to complete more education, certifications and work experience than bookkeepers.

It can be hard to evaluate the suitable time to employ an accounting expert or accountant or to establish if you need one in any way. While lots of tiny services work with an accounting professional as a professional, you have a number of options for taking care of economic jobs. Some small service proprietors do their own bookkeeping on software their accounting professional suggests or utilizes, offering it to the accounting professional on an once a week, monthly or quarterly basis for activity.

It may take some background study to find an ideal bookkeeper due to the fact that, unlike accountants, they are not needed to hold a specialist accreditation. A strong endorsement from a trusted colleague or years of experience are important elements when employing an accountant. Are you still not exactly sure if you require to hire someone to assist with your books? Here are three instances that suggest it's time to work with an economic specialist: If your tax obligations have actually become as well complex to take care of on your very own, with numerous income streams, international financial investments, several reductions or various other considerations, it's time to work with an accountant.

The Best Strategy To Use For Cfo Company Vancouver

For little companies, experienced money administration is an important facet of survival and also growth, so it's sensible to collaborate with a monetary expert from the start. If you like to go it alone, take into consideration beginning out with accountancy software program and keeping your books carefully approximately day. This way, must you require to employ a specialist down the line, they will certainly have visibility right into the total monetary background of your other organization.

Some source interviews were conducted for a previous version of this post.

Getting My Vancouver Tax Accounting Company To Work

When it concerns the ins as well as outs of tax obligations, bookkeeping and finance, however, it never hurts to have a skilled specialist to count on for advice. A growing variety of accountants are also looking after points such as capital estimates, invoicing as well as HR. Eventually, a number of them are tackling CFO-like duties.

Small company proprietors can anticipate their accountants to assist with: Choosing business framework that's right for you is essential. It affects exactly how much you pay in tax obligations, the documentation you need to submit and your personal responsibility. If you're seeking to convert to a various company framework, it could cause tax consequences and various other complications.

Also companies that coincide size and also market pay extremely various amounts for audit. Prior to we obtain into buck figures, allow's speak about the expenses click for source that go right into small company audit. Overhead expenses are expenses that do not straight become a profit. Though these expenses do not exchange cash money, they are required for running your service.

The smart Trick of Virtual Cfo In Vancouver That Nobody is Discussing

The average cost of accountancy solutions for tiny organization differs for each unique circumstance. The typical regular monthly accountancy costs for a little service will climb as you include a lot more solutions as well as the tasks get tougher.

You can record transactions as well as procedure payroll utilizing on the internet software program. Software application options come in all shapes and sizes.

10 Simple Techniques For Tax Consultant Vancouver

If you're a new company proprietor, do not forget to factor bookkeeping costs right into your spending plan. Management expenses as well as accountant charges aren't the only audit expenses.

Your time is additionally useful as well as should be thought about when looking at bookkeeping expenses. The time spent on accounting tasks does not generate revenue.

This is not planned as lawful guidance; to learn more, please visit this site..

How Vancouver Accounting Firm can Save You Time, Stress, and Money.